Student money diary

Find out other ways students fund their studies if they are entitled to lower student loan because of their household income

To help you understand more about how students fund their studies and university life, our students have been keeping a money diary to show you their typical weekly spend

Student loan contributions are based on your current household income. Below you'll find a diary from a Film Production student, who receives the minimum student loan contribution. You'll see how they manage their money over a typical week, including earning extra money to fund their social activities.

Course: Film Production

Where do you live? In a house share, in Southsea, with 7 other people.

How do you fund your studies? Student Finance England

Scholarship/bursaries: None

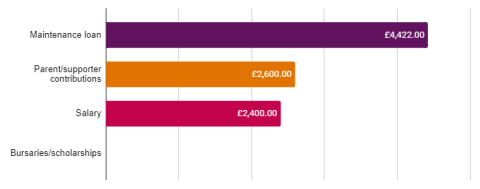

Annual income

A typical week

Monday – £0 spent

I worked from home so didn’t spend any additional money on this day. I worked part-time for my job as a content creator, including answering student questions online, and editing a TikTok video. I spent 2 hours on this, earning just over £18.

Since I had some spare time, I completed some online surveys. I use websites such as UserTesting and Prolific to earn some extra cash. Although they don’t pay much, the money adds up and allows some extra room in my budget.

Usually I do a big grocery shop every fortnight to last me 2 weeks (costing around £40); this means I eat at home a lot or make myself a packed lunch to save money on food.

Tuesday – £16.53 spent

I was on set in the afternoon today. We require a lot of equipment which often means paying for taxi transportation. I paid for a return taxi (Uber) costing me £9.33.

I also went to Hampshire Boulevard for their weekly bingo night with my friends. I bought 2 tickets costing £5 total, and was 2 numbers away from winning £150! I also bought a drink from the bar (£2.20).

Wednesday – £9.50 spent

I was in university for a lecture and a studio shoot. I bought lunch from the cafe (a sandwich, chocolate bar and packet of crisps), totalling £5 and also bought snacks for the crew (£4.50). They loved the cookies, chocolate, and sausage rolls!

Thursday – £0 spent

I didn’t spend any extra money today as I was working at home, and had plenty of food in the fridge. I finished more work for my content creation job, gaining £18. Because I work from home a lot of the time, I have to have a good internet connection which means I opted for the faster internet speed in my monthly bills package (totalling £59.75 per month).

Friday – £5.35 spent

On Fridays I have 3 lectures and today I also needed to collect kit from the loan store. It was a rush so I decided to buy lunch from the cafe before my lecture started, totalling £5.35 for a toasted sandwich, chocolate bar, and packet of crisps.

Saturday – £8.58 spent

I was filming on the Isle of Wight today. The organisers of the event paid for our ferry tickets, but I paid for a taxi to take our equipment to the port. This cost me £4.58 (Uber).

We had some time in between shooting and leaving so treated myself to some vegetarian nuggets and chips from the local chippie (£4).

Sunday – £10 spent

I spent the day on the beach with my friends. I filmed a TikTok and YouTube video for my job as a content creator and later edited the video, earning around £36. The video I was creating was called “Portsmouth on a tenner” so I spent £10 for the day!

I bought some vegetarian chicken burgers and sausages (£4.85 from Iceland), a disposable BBQ (£2.15 from Tesco), and managed to find a couple of rounders bats and a tennis ball for just £3 from Poundland. I’d say it was a very student budget friendly day out!

Total spent across the week: £49.96

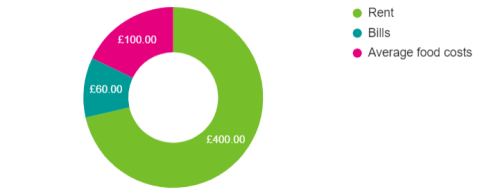

My monthly spending

More about me

Before coming to university, what conversations did you have about money?

I had spoken to my parents about how they budget and they had created a budgeting spreadsheet with me so that I knew how to do it. This really helped me when I started uni as it didn't all feel so overwhelming when I had it written down in front of me.

How do you feel about your finances now you’re here?

I feel like a grown up! When you learn how to manage your money and start to budget properly you really feel like you're maturing. Now that I've been doing it for almost 2 years I feel confident that, in the future, I will be able to do it independently.

Having a part time job with the uni definitely helped me feel more confident in my finances because, when I started uni, I had budgeted without it so it meant that I always had a little extra money to work with if I needed it.

What do you wish you’d known about funding your studies before coming to university?

I wish I'd known not to worry about it. Up until year 12 I didn't want to go to uni because of the finance side of things and knowing that I'd receive the minimum maintenance loan made things a lot harder in my head. But you always find a way to manage. It's a bit daunting at first but once you ease into it, it gets so much easier!